Bitget Hot Takes (November 14 - November 20)

Bitget Hot Takes is the exclusive weekly newsletter series by Bitget Academy, the 360-degree onboarding guide for all crypto enthusiasts.

Bitget Hot Takes last week can be found here.

Central Themes

• BGB made minimal losses.

• U.S. House committee decided to hold a hearing on FTX collapse and crypto fallout.

• More businesses fell prey by FTX.

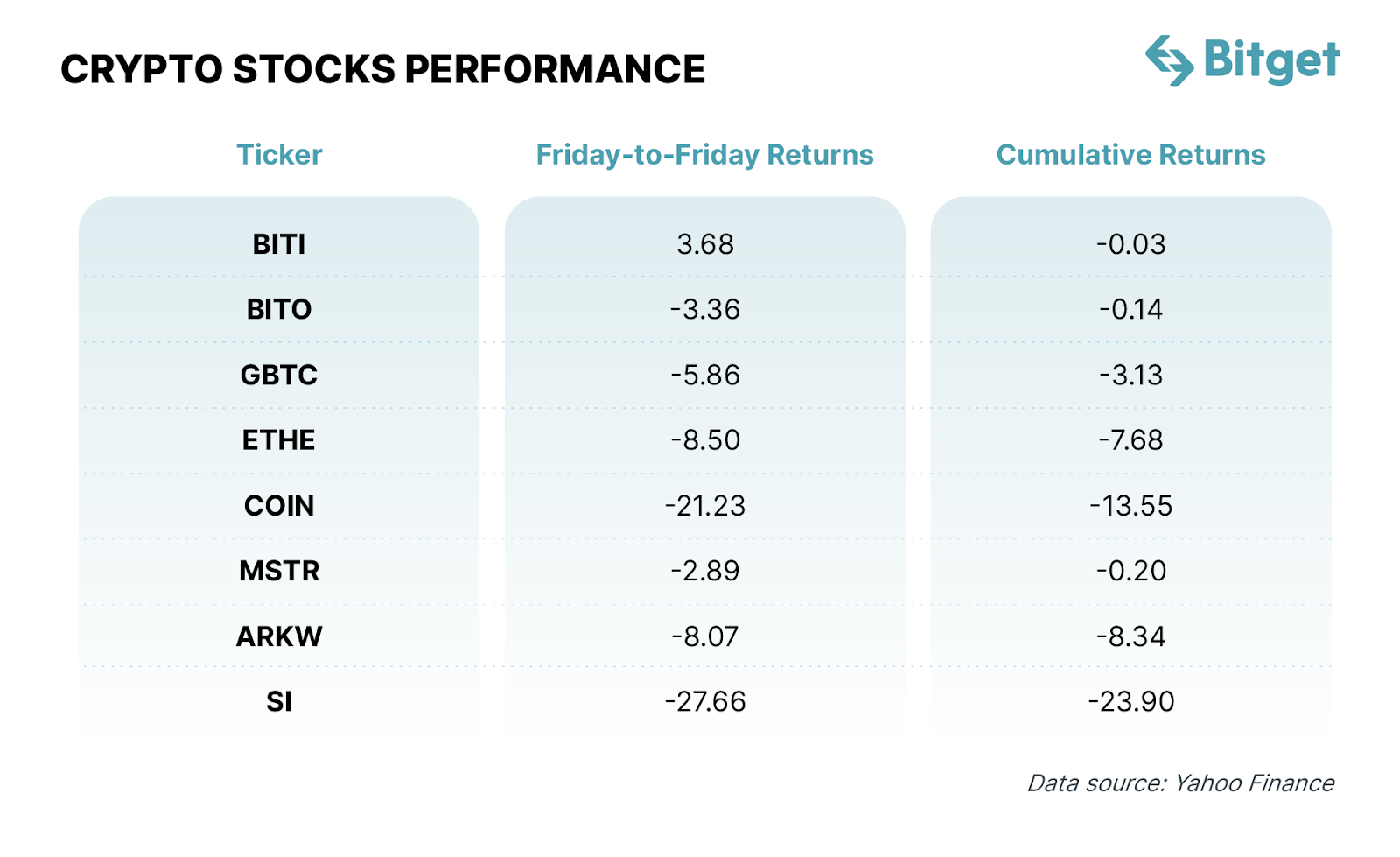

• Silvergate stock saw the biggest loss in crypto stocks.

• Man Group launches a new crypto hedge fund despite bear markets.

BGB Made Minimal Losses

Another red week for crypto. BGB briefly fell to US$0.175966 on Monday before reclaiming the US$0.18 mark for the next three days. Another weekly low was recorded at US$0.176249 on November 17, just before BGB regained momentum. BGB weekly growth stands at -1.12%, which is a minimal loss compared to ETH’s 2.92% and BNB’s 3.34%.

As BGB is quite new, supply and demand and the corresponding price oftentimes are not affected by market changes. But we can see that BGB tends to resist downturns better than other major cryptocurrencies, and it’s never too late to scoop up a bag of your own. Don’t forget to check out BGB’s price movements for the last few months:

The Contagion Effect

FTX users range from venture capitalists, hedge funds, expert traders to crypto projects, some of which are rumoured to have stored their whole treasuries on the exchange. The empty vault of FTX and its estimated US$8 billion hole on the balance sheet continued to affect other industry actors:

• Multicoin Capital: more than US$25 million exposure

• Ikigai Asset Management: “large majority” of assets

• DeFi lending platform Oxygen: FTX was entrusted with 95% of its MAPS/OXY token

• Crypto lender Vauld (the one filing for bankruptcy in July/August after the collapse of Terra): US$10 million

• Uruguayan unicorn DLocal: US$5.6 million

• Nickel Digital Asset Management: US$12 million

• DeFi protocol REN: expected Alameda’s funding at US$700,000 per quarter, current account balance at approximately US$160,000

• Nigerian Web3 startup Nestcoin: “a significant proportion of stablecoin investment”

• BlockFi: preparing for the possible Chapter 11 Bankruptcy

• Crypto lender Salt: halting of withdrawals, citing FTX impact

• Crypto exchange Liquid (acquired by FTX): halting withdrawals

• Genesis Trading: halting withdrawals

• Gemini Earn: “not be able to meet customer redemptions within 5 working days”

Now talk about big names who have to write down their stake in FTX to zero: the Canadian major public pension Ontario Teachers' Pension Plan (US$95 million loss), Government-owned Temasek Holdings (US$275 million loss), venture capital firm Sequoia (US$210 million) and SoftBank (US$100 million). These four have invested roughly US$680 million in FTX within less than two years. And on a side note, Visa ended its crypto debit card partnership with the hobbled FTX. The debit card was reported to be available in 40 countries in LATAM, Europe and Asia for shoppers with cryptocurrency holdings.

Crypto prices slid a bit further down this week, with Bitcoin’s weekly low showing US$15,931.39 and Ethereum’s weekly low of US$1,190.22. Crypto stocks mirrored the movement and were also impacted by several bad news, including:

• Regulatory filing shows that Brian Armstrong, CEO of Coinbase, has sold more than US$1.6 million in COIN shares

• Genesis Trading’s suspension of withdrawal triggered fears around the solvency situation of Genesis Global Capital, which is the sister/brother entity of Grayscale Investments

• Discounts of Grayscale Bitcoin Trust set the new all-time low of 45.08% as of Friday (November 18, 2022)

• Again, fears around Silvergate’s exposure to FTX and crypto prime broker FalconX’s announcement to “not be using Silvergate SEN and wires, effective immediately” have caused a 23.90% decrease in SI. However, the market consensus (closing price on Friday) is expecting further sinking in SI price.

One good thing is a positive Friday-to-Friday return of BITI, which could very well describe the expectation that Bitcoin price should hold or climb higher.

Who Are Still Building?

Emurgo, the official commercial arm of Cardano, has announced the plan to issue a Cardano-based stablecoin called USDA, starting from early 2023. This allows for easier trading, lending/borrowing, and staking - the core activities of a thriving DeFi ecosystem. Cardano is currently the 8th largest cryptocurrency by market cap.

A total of US$222 million has been raised by developers in the digital space in addition to the new crypto hedge fund by Man Group, the world’s largest publicly traded hedge fund company:

• Biggest deal: US$200 million by Matter Labs, developer of zkSync

• Web3 advertising and experience platform playEmber: US$2.3 million

• NFT fraud detection startup Yakoa: US$4.8 million

• The digital wallet for the LATAM Zulu: US$5 million

• Developer company Anode Labs: US$4.2 million for a decentralised network connecting individuals and businesses with energy storage assets

• Web3 gaming protocol Heroic Story: US$6 million

The FTX debacle has encouraged more users to join the decentralised space. UNI and COMP have registered a 4.04% and 6.02% jump in weekly return as the top two DeFi blue chips. The seven-day volume of UNI hit nearly US$2 billion in the week from November 7 - November 13 before falling by half this week. COMP volume over the same periods was recorded at US$535.9 million and US$131 million, respectively.

The Latest Bitget News

To our Brazilian crypto lovers: Bitget has launched operations in Brazil! What’s more important is we have secured a partnership with Pix, the Brazilian government payment system, to allow fiat trading pairs of the Brazilian Real! This is also the activation of Bitget’s bigger and better on-ramp program.

Do you know that Bitget’s KCGI officially begins today? You’ll be automatically signed up for the Individual Competition and Invitation Competition when you click on the register button, and remember to assemble your football team as soon as possible to have more winning chances! Trading while watching the World Cup never sounds more exciting with Lionel Messi and more than US$3.5 million in rewards!

New for us, new for you: Bitget Insights is officially launched! Bitget Insights is a feature that allows high-quality traders to share their professional opinions publicly to not only help their fellow traders but also earn more followers on Bitget Copy Trade. For a limited time, Bitget Insights is open for all users - the best will secure the right to permanent publishing and access to juicy rewards!

New Listings

Spot Trading

New Events

Enjoy safe trading on Bitget! Share $5M Builders Fund, $20K prize pool Ledger Wallets

Triple Gifts! Contact VIP to Get 400 USDT, 45% Trading Fee Rebate Plus a 60-Days VIP+1 Trial!

High-Interest Earn in Limited Time and Amount, With VIP Privileges and BGB Packages!

WEDNESDAY SUPER SALE! Enjoy 10% OFF on Your Crypto Purchase through 3rd Party Payments!

Bitget x ATAS Promotion: Share $40,000 in Trading Bonuses!

BRL Carnival I:Deposit BRL with Zero Fees and Get up to 15 USDT Reward

Invite A Friend To Share $10 - No Limits On Rewards!

100 Dollars Every week for Merchants! On Bitget P2P!

GET $5 FREE on your First Trade, Available to All!

Good Reads

Answers To The Most Common Bitcoin-Related Questions

What Is A Fiat Or Payment Gateway?

How To Choose The Right Trader To Copy On Bitget One-Click Copy Trade

Follow us for the latest updates: Twitter | Telegram | LinkedIn | Facebook | Instagram