Trading basics

Stop Loss Levels and Take Profit Levels Explained

Beginner

2022-12-08 | 5m

Having trouble determining when to close your trade for either a loss or locking in profits? This article will help you understand what to look out for and what factors to weigh when making decisions.

What are stop-loss (SL) and take-profit (TP) levels?

Take-profit (TP) levels are price levels where you have decided to lock in and bank profits from a successful trade. A stop-loss (SL) refers to a price level where your trade idea is invalidated, and you will close your trade for a loss in order to avoid unrepairable damage to your portfolio.

Taking profits and losses can be done in various ways. You can decide to close the trade manually with an order type of your choice or automate your decision-making by using the exchange's take profit and stop loss features. Read more about the

different order types in our article series consisting of two parts.

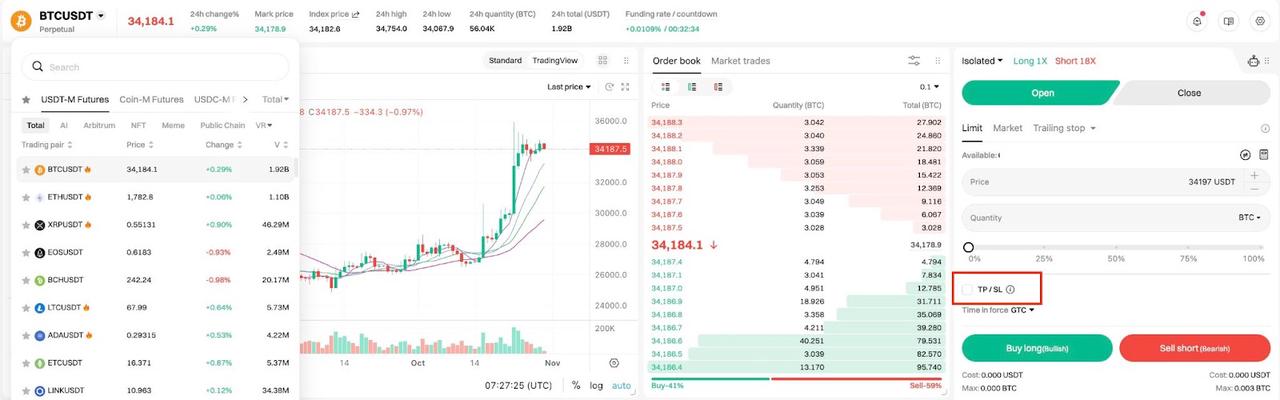

Example of Bitget Futures Order with TP/SL features

Why use them

First and foremost, trading is a game of probabilities, not certainties. Stop losses help you keep your risk management in check. It would be highly unsustainable if you entered into trades without having an idea of where you wished to get out. This would not only quickly lead to the depletion of your funds if the scenario you speculated on does not play out, but also lead to stress and making decisions based on emotions rather than rational thinking.

The same can be said for taking profits. If a trade does play out in the direction that you want, only for the price to reverse and seeing a winning trade turn into a losing trade can play tricks on the mind.

Trading under a heavily influenced emotional state often leads to bad decisions. This is the reason why many traders automate and preset their take profit and stop loss levels once they enter a trade.

Lastly, identifying stop loss and take profit levels can help significantly with honing one's trading strategy. By identifying them, you will know exactly how much money you would be losing should the trade not play out the way you intended it, and you will also know exactly how much money you will make when taking the trade. This information will not only help you figure out whether the trade is actually worth taking, but can also help you make future projections of your portfolio growth curve.

How to determine to stop loss and take profit levels

Deciding on taking profits and placing stop losses is one of the most difficult things to do when trading and can be done in countless ways. It often depends heavily on what strategy you are utilizing. To help you get on your way, here are three options you can consider looking into to help decide where your levels are going to be.

Price structure

In

technical analysis, the structure of price forms the basis of all tools. The structure on the chart represents an area where people valued the price as high as resistance and a place where traders valued the price as low as support. At these levels, there is a high likelihood of increased trading activity, which can provide great places for prices to take a breather and then either continue or reverse. This is why many traders consider them checkpoints, and therefore those who use this method generally place take profits just above support and stop losses just above resistance.

Volume

Volume is a great momentum indicator. However, it is a bit less exact, and more practice is required to read into the volume, but it is a great method to see whether a trending move might come to an end soon or when you are wrong on the direction of the trade. If the price goes up on a continuous increase in volume, it indicates a strong trend, whereas if the volume depletes with every thrust up, it might be time to take some profits. If you are in a long trade and price moves up on slow volume and price starts to retrace on an increase in volume, it might indicate weakness and might mean a reversal instead.

Percentages

Another method is to think in percentages, where traders have a fixed percentage in mind that they wish to use to place their stop loss and take profit levels. An example could be when a trader closes their position whenever the price has moved 2% in their favor and 1% whenever the price has moved against them.

Find your own comfort zone

There are countless other ways on how people decide on their take profit and stop loss levels. What is important to notice is that the three examples above find their roots in different origins. Price structure is technical analysis, volume is price action, and percentage is mechanical approach. There is no right or wrong method per se, but always keep in mind that what works for someone else does not mean it will work for you!

Share

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up nowWe offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now