The Ultimate Bear Market Strategy: What You Need To Know About Shorting?

Are you still investing in crypto, like buying low and selling high? The actual fact is, you buy at a high price and face a sudden recession. Finally, you are forced to HODL until the next bounce of crypto.

However, what if prices are continually declining? Why do professional traders still profit from trading? Shorting is one of the strategies taken by professional traders to profit even in a recession. It is a risk management and hedging tool to resist price risk.

Sick of your money getting trapped in the crypto market? Let us tell you more about shorting so you can still profit during the bear market.

A simple explanation of shorting

Shorting means selling a crypto asset at an early time and buying it back later. The trader who carries out shorting expects a decrease in the price of the asset in the future. If the price really decreases in the future, the traders can profit from the price difference.

Traders do not need to buy and hold any assets, but they still make money in the bear market. The opposite strategy of shorting is long positions, the traders who carry it expect an increase in the price of the assets in the future.

In the crypto market, shorting is commonly used by traders or crypto miners. In order to reduce the risk of volatility, miners may take a short position to secure the value of the Bitcoin they mined. They have to cover the mining costs, including electricity and hardware.

Not only in the crypto market, shorting is also a common strategy in stock, commodities, and foreign exchange markets.

How do you make money by shorting? A Bitcoin shorting example

Calculating the profit is simple: take the initial selling price (at a higher price point) and then subtract from it the subsequent buying-back price (at a lower price point).

For example, a trader can borrow one Bitcoin (BTC) at US$50,000 and sell it immediately. BTC subsequently drops to US$30,000, and the trader decides to buy one back to return to the lender. His profit will then be US$20,000 minus any transaction/exchange fees.

While shorting is a good way to earn profits even in a bear market, naturally, there are also various risks involved. Mathematically, unlike long positions, where losses are capped, and earnings can be infinite, short positions have these traits reversed. Because you’re predicting the price to fall, the most it can drop to is US$0, meaning your potential profits are capped at 100%. On the other hand, because the maximum price of a cryptocurrency is infinite, your exposure to losses is, therefore, also infinite.

If you’re margin trading, your risk exposure will also increase significantly. Not only will you have to cover potentially unlimited losses, but you’ll also be responsible for any margin calls while your positions are open. If you’re unable to meet margin calls or your losses exceed 100%, exchanges would likely liquidate your account automatically.

Through setting up a stop-loss strategy, you can manage the risk and reduce the loss. Below, we will talk about how to do shorting.

New to margin futures trading? Here are some guidelines and tips:

Bitget Futures: Operational Guidelines

Step-by-step guide of crypto shorting on Bitget

If you want to do shorting on Bitget, here’s the step-by-step guide:

1. Create an account on Bitget, complete the identity verification, or log in to your existing account. Then, navigate to the ‘Trade’ section and select the type of contract you want to purchase. Select ‘Coin-Ⓜ Futures’ in the upper navigation bar.

2. Before opening a position, if there are no assets in your Coin-Ⓜ Futures account, you can click on ‘Transfer’ to transfer crypto from other accounts to your futures account. There is no fee for internal transfers.

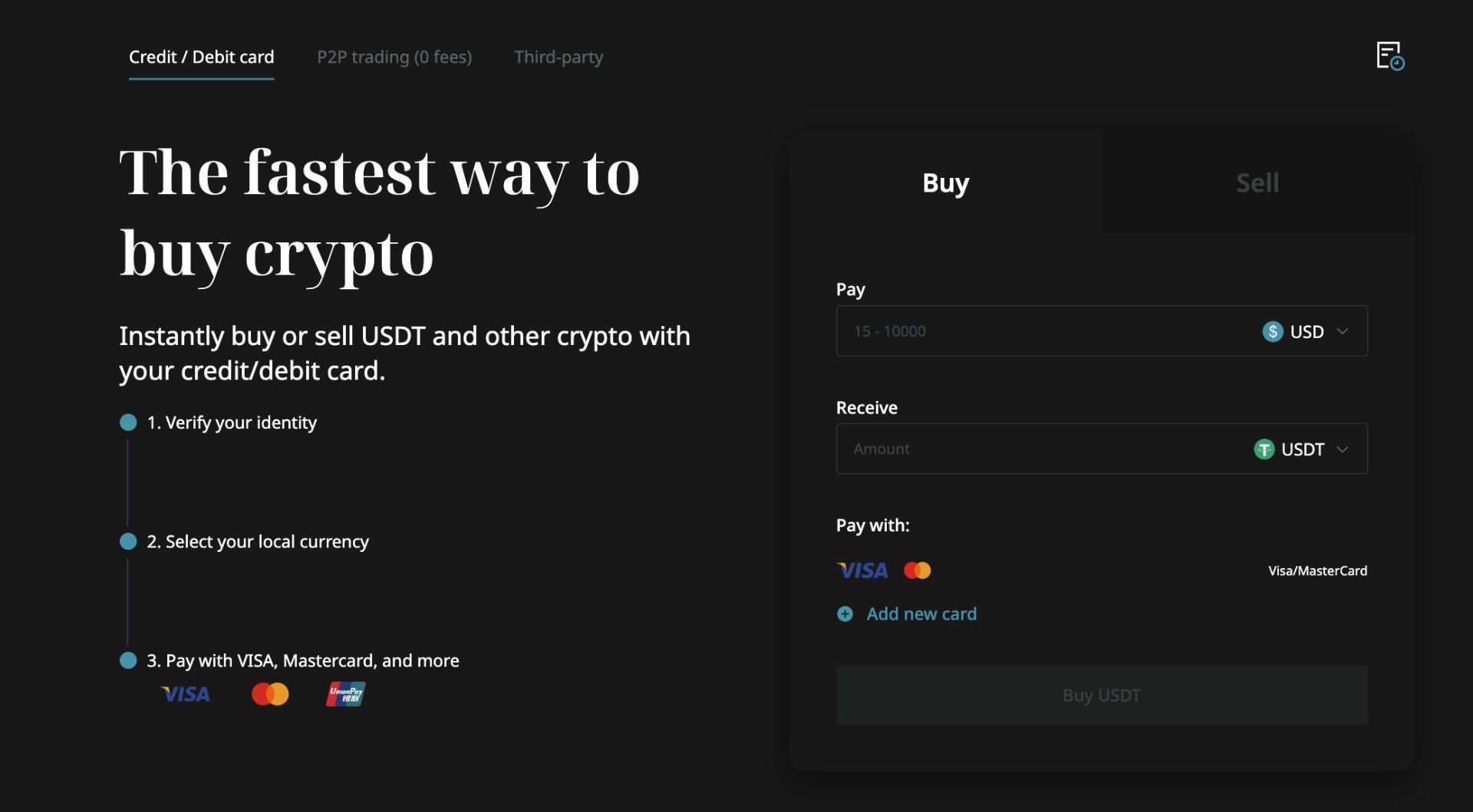

Or you can hit ‘Buy Crypto’ to purchase some Bitcoin (BTC), Tether (USDT), or other supported cryptocurrencies for futures trading. The easiest way to do this is to purchase them with your debit or credit card.

For more: Buy Crypto With Fiat Currencies on Bitget

3. After selecting the trading pair, margin mode, order type, and leverage, enter the price and quantity, and select the direction to place an order.

For more detailed instructions, check The Bitget Coin-Ⓜ Futures: User Guide, or check this video.