BTC Volatility: Week in Review September 23–30, 2024

Key Metrics: (September 23, 4pm Hong Kong time -> September 30, 4pm Hong Kong time):

BTC/USD unchanged ($63,500 -> $63,500), ETH/USD down 1.5% ($2,640 -> $2,600)

BTC/USD ATM volatility in December (end of the year) decreased by 2.6% (59.4 -> 56.8), and the risk reversal volatility on December 25th decreased by 0.5% (3.2 -> 2.7)

Overview of spot technical indicators

The market briefly broke through the key resistance level of $65.2-66k, but price action was blocked here again and the first challenge of the long-term flag resistance level has so far failed.

The resistance of this range can now be seen as a short-term support and if broken, the price could drop to $62.5k.

Long-term structural bullish, but short-term tactics remain neutral; need to wait patiently for a clear signal of breaking through $66k before considering adding new long positions.

Market events:

China finally introduced its long-awaited stimulus policy, which has driven a new round of bullishness in regional stock markets and boosted growth expectations. If Chinas stimulus policy is successful, its transmission effect is expected to keep global inflation at a high level, which may lead to lower real interest rates worldwide, especially in the context of most G10 central banks (except Japan) being in a rate cutting cycle. As a result, cryptocurrency prices rose at the beginning of the week, challenging the highs of the local range, but then retreated and ultimately remained generally unchanged during the week.

Despite the renewed crypto-friendly rhetoric from the Harris camp last week, the US presidential election polls are back to being close to 50/50. Both camps are expected to continue to make overtures to the crypto community in the run-up to the election, so we need to be cautious with this news, especially with any potential policy shift from Harris/the Democratic Party.

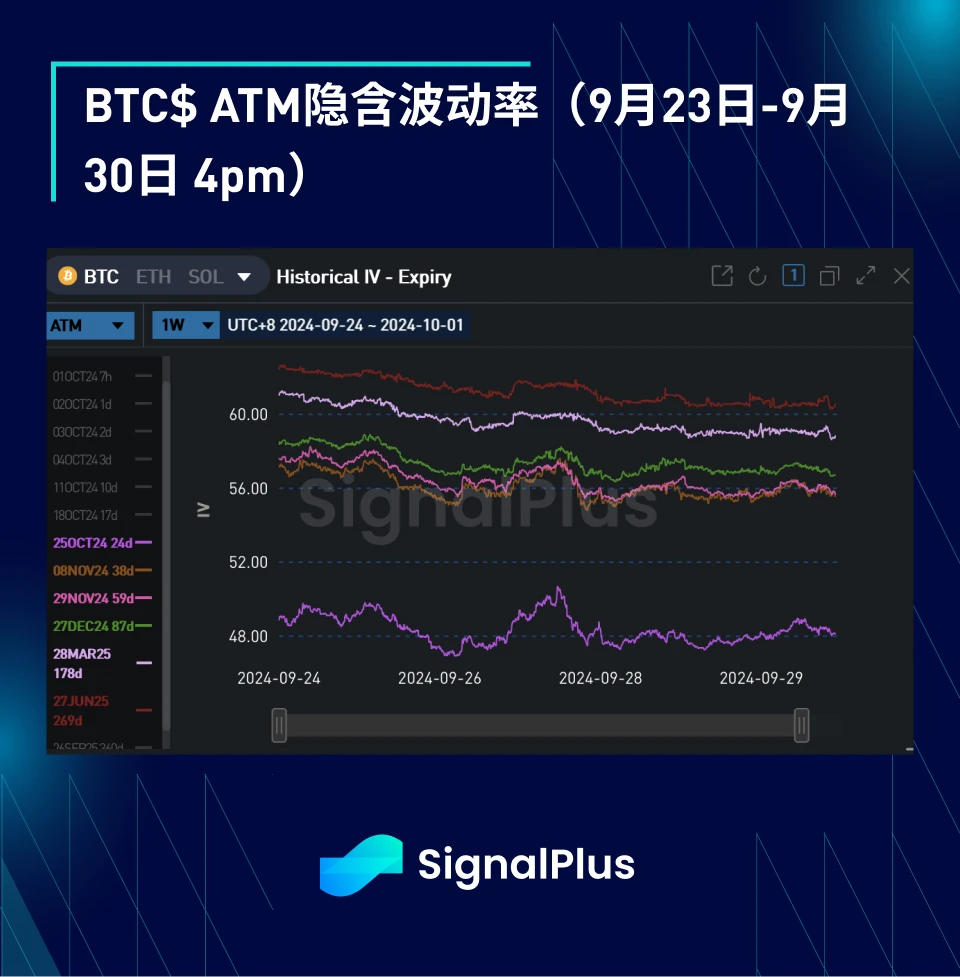

ATM Implied Volatility:

BTC $ATM Implied Volatility (September 23-30, 4 pm, Hong Kong Time)

Realized volatility remains extremely low, with spot prices rising from $63.5k to $66k last week, but there is a large sell order ahead of key resistance levels. High frequency trading and fixed-term realized volatility is around 35%, while intraday implied volatility is in the 45% - 50% range.

Volatility prices fell sharply across the board this week due to the lack of upward momentum in realized volatility and the absence of new catalysts. Volatility in options expiring in November fell by more than 2 vol. The current risk-friendly macro environment seems to support a buy on dips strategy, but this strategy has a volatility-suppressing effect. A substantial price breakthrough will require more news such as the US election or Trumps support.

We expect Gamma (which also drives the front-end implied volatility contracts) to remain weak in the coming weeks as the spot price consolidates in the $62.5-65.5k price range (unsuccessfully breaking out of the overhead resistance).

Election event volatility is falling again as markets remove risk premiums from the implied volatility curve; with less than 4 weeks to go until the election, market attention will inevitably turn to the next potential catalyst for this cycle, and we expect event volatility pricing to rise as we approach the election.

Skewness/Convexity:

Despite spot prices rising midweek, skew prices retraced last week’s upward sloping move as both realized and implied volatility moved lower. Covered call strategies and underperformance of volatility as spot prices moved higher drove the liquidation of skew positions.

The butterfly spread has risen this week as the market has increased demand for price breakouts on both sides, especially during the election, which has driven the pricing of the November butterfly spread higher. We expect volatility to rebound on either side of the $60-70k range, so this pricing is generally reasonable.

Good luck this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Orderly Network Integrates Chainlink Price Feed on Arbitrum Mainnet

Tether Treasury mints 2 billion more USDT

215 Arrests as $230M Crypto Scam Defrauds 15,000 in S. Korea

Police tracked the flow of funds across 1,444 bank accounts used by the group.

Delhi Police Arrests Bengal Man in ₹2000 Cr WazirX hack

Alam created a WazirX account under the name Souvik Mondal, which he later sold via Telegram to an individual named M Hasan.